Anticipated Foreign Bank Entry in Ethiopia Authorized 2023

Anticipated Foreign Bank Entry in Ethiopia are Authorized in 2023. Foreign bank entry into Ethiopia, long anticipated by some and feared by others, was legalized this year.

The decision to liberalize the banking sector was made by the Ethiopian Council of Ministers during its 13th regular meeting held on September 03, 2022. This verdict is one item in a string of liberalization the country has been enforcing since the appointment of PM Abiy Ahmed in 2018.

While this novel legislation allows interested foreign investors to engage in banking services in the country, its actual implementation will necessitate the passage of new laws. Many experts speculate that this will take a couple of years, in which time local banks can better ready themselves.

In spite of their capacity and willingness to enter the market, international competitors have been barred from doing so for fear of creating unrivaled competition. It is true, and likely, that foreign banks will have the upper hand due to their superior technology, experience, and capital.

With a combined shareholder number likely does not exceed one million and the protection afforded to them by the country’s policy, the stakeholders of domestic private banks have been earning a return on equity of between 20 to 50% per annum, far more than the 10% global average.

Following the entry of foreign banks, local financial institutions are sure to see a drop in revenue and profit as they lose the closed economy privilege afforded to them on those good old days.

The Current Banks, without the Foreign Bank Entry in Ethiopia

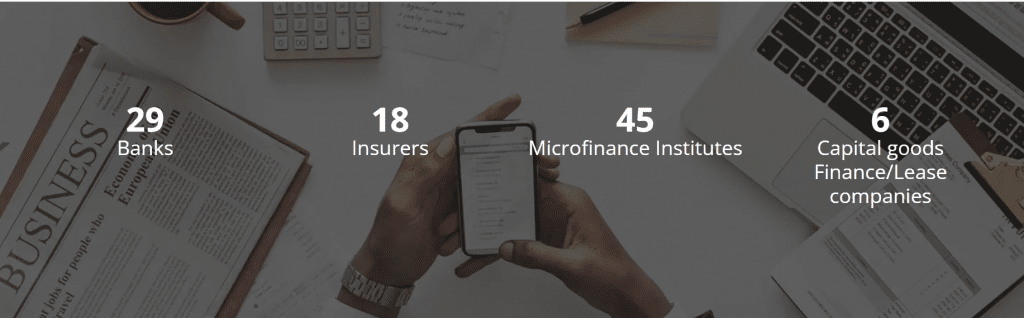

Ethiopia currently has 30 local banks, a significant increase from the 18 that were in operation last year. Even so, H.E Yinager Dessie (Ph.D.), Governor of the National Bank of Ethiopia (NBE), has earlier noted that the banks’ capital fulfillment and strength, rather than their large number, is the pressing issue at hand.

In accordance, NBE has increased its efforts to force mergers and acquisitions on local banks in order to ensure their survival in the face of foreign competition, and provide abundance bank vacancies for employees.

Although there are many fears regarding this move, the Council of Ministers put forth several rationales for their decision to let foreign bank entry in Ethiopia local market. Among them are:

- An Influx of new technology, knowledge, and skills into the sector

- Provision of adequate financial services and increased foreign exchange inflows

- Creation of job opportunities for the many unemployed and underemployed youth

- Increasing the country’s financial sector’s global competitiveness, among other things.

A point that confused many after the legislation was announced was in what particular way foreign banks could invest in Ethiopia. Well, according to the National Bank of Ethiopia, foreign banks can come to Ethiopia in four ways.

Foreign Bank Entry in Ethiopia 4 Ways:

- Opening a branch (es)

- Opening a fully owned subsidiary

- In a joint venture with one of the local banks

- Lastly, opening commercial representative Office

Prior to this regulation, nine foreign banks have been operating in Ethiopia since 2015, as reported by Business Info Ethiopia.

The movement was initiated by the state-owned Turkish bank Ziraat, which was vying to be the first foreign institution to obtain a banking license in Ethiopia that year.

European Investment Bank, Standard Bank, Deutsche Bank, Commerz Bank, KCB Bank, Bank of Africa, Export-Import Bank of India, and Equity Bank are soon followed in the same footsteps.

Despite Ethiopia’s prohibition on full banking operations by foreign banks, such as direct lending and deposit-taking, the institutes were permitted to maintain a representative office in the country.

According to Afro Tender, this means that banks located in the country could not generate deposits or lend directly to Ethiopian companies and households. However, they could conduct research and credit assessments to allow lending from their respective countries’ headquarters.

While this arrangement has allowed these banks to study the Ethiopian market, the time to use the data they’ve accumulated in nearly a decade has finally come with the liberal policy adopted this year.