The National Bank of Ethiopia: A Quick Overview

The National Bank of Ethiopia was inaugurated in 1963 to engage in the singular task of central banking for Ethiopia. Prior to proclamation 206/1963 during the Imperial regime, the institution was engaged in the double duty of commercial and central banking. The National Bank was given considerable administrative autonomy and legal personality in addition to an increase in capital.

The Role of National Bank of Ethiopia

The roles the National Bank performed went through a myriad of changes in tandem with changes in government administrations before settling on the market-based economic policy proclamation 83/1994

- Manage money and credit supply and availability, as well as interest rates and other adjustments.

- Put restrictions on gold and foreign exchange assets held in deposits by banks and other financial organizations licensed to trade in foreign exchange.

- Establish limitations on banks’ and other financial institutions’ net foreign exchange positions, as well as the terms and quantity of their external debt.

- Provide banks and other financial institutions with short and long-term refinancing options. Additionally, the proclamation augmented the Bank’s paid-up capital by ETB 20 million.

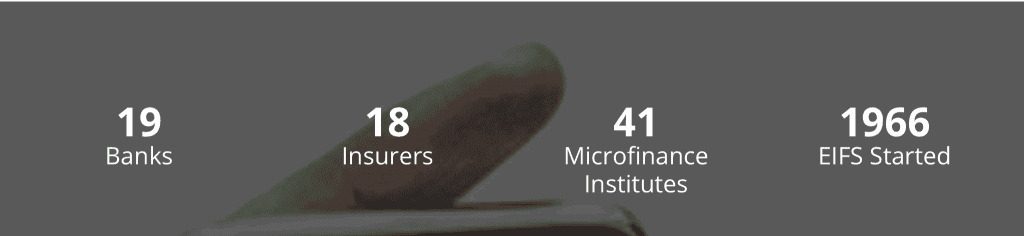

As of 2022, the National Bank of Ethiopia oversees the 19 banks, 18 insures, 41 microfinance institutions, and 1966 Ethiopian institutes of financial studies that exist in the country.

History of the Bank: From Inception to 2022

The long history and origination of the National Bank of Ethiopia dates back to 1905 when an agreement was reached between Emperor Menelik II, the then ruler of Ethiopia, and Mr. Ma Gillivray, representative of the British owned National Bank of Egypt.

The pact resulted in the inauguration of the first bank in Ethiopia in Feb.16, 1906. The bank was christened as the Bank of Abyssinia and was under the full management control of the Egyptian National Bank until the Bank’s liquidation in 1931. This happened due to a number of reasons, some of which included its inefficiency and profit-driven nature.

Immediately following this event, Ethiopia formed the Bank of Ethiopia, the first fully-African owned bank on the continent, by an official order on August 29, 1931 with an initial capital of £750,000.

The bank took over the commercial duties of the former bank and continued successfully before briefly ceasing operation during the Italian invasion of 1935. Upon its reinstitution, the State Bank of Ethiopia was granted the sole right of issuing currency and dealing in foreign currency while also acting as the principal commercial bank in the country. This went on until the proclamation mentioned at the very beginning (206/1963) divided the function of commercial and central banking attributing the former to National Bank of Ethiopia and the latter to Commercial Bank of Ethiopia.

Fun fact: In contrast to the prior State Bank of Ethiopia, the new Commercial Bank of Ethiopia employed only Ethiopians.

However, on September 1, 1976, monetary and banking proclamation No. 99 of 1976 went into effect, defining the National Bank’s duty in accordance with the country’s socialist economic principles adopted during the Derg regime.

Besides altering the role of this institution to participate actively in national planning and broad its area of regulation to include other financial institutions such as insurance institutions, credit cooperatives and investment-oriented banks, the declaration reintroduced the term Ethiopian “birr”, replacing Ethiopian dollar as the legal tender.

Only three banks remained in the finance industry left behind by the socialist-oriented government, each with a monopoly in its own market: The National Bank of Ethiopia (NBE), the Commercial Bank of Ethiopia (CBE), and the Agricultural and Industrial Development Bank (AIDB)

The Ethiopian People’s Revolutionary Democratic Front (EPRDF) established a liberal economy system when the Derg dictatorship, which had dominated the nation for 17 years under a command economy, fell apart in 1991. This brings us back to the Monetary and Banking Proclamation of 1994 established Ethiopia’s national bank as a judicial body apart from the government and defined its chief functions listed above.

To read more on the National Bank of Ethiopia, it’s directives and publication, visit their official page using the link: nbe.gov.et