Oromia Bank Review

Oromia Bank

Current Account Protection

Diaspora Focused Financing

Bank Guarantee Service

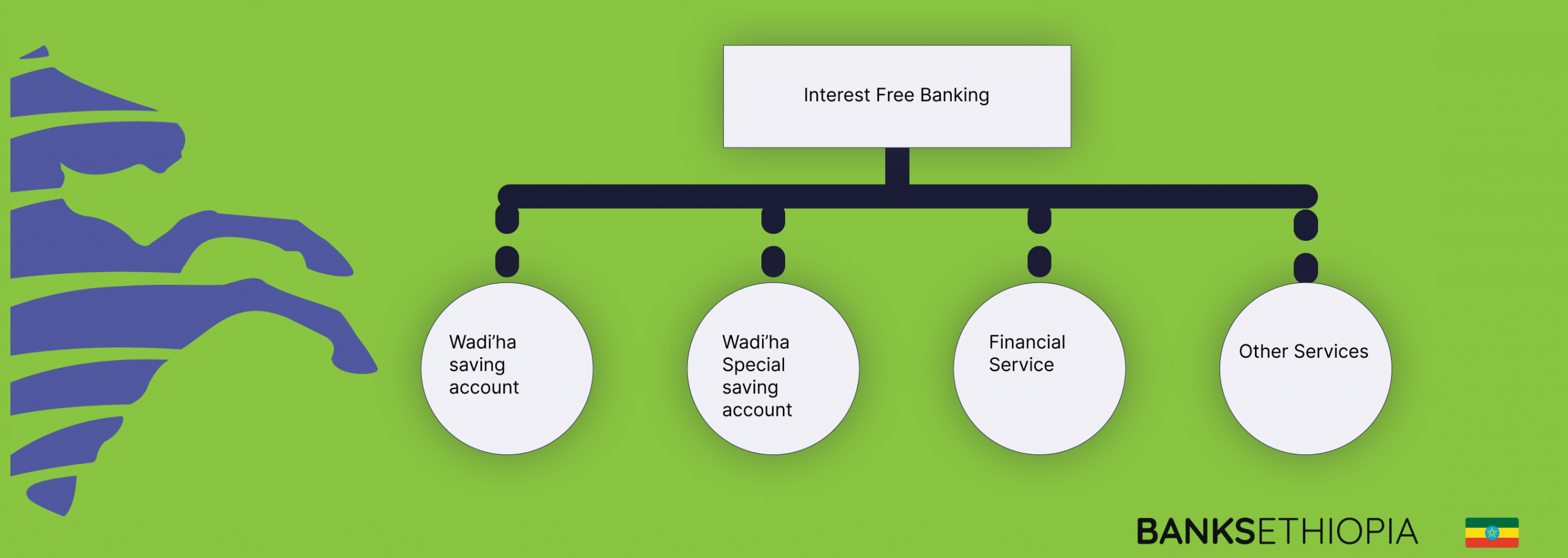

Interest Free Banking

Multi Service IFB

Pros and Cons

Various Interest-Free Banking Services

Reliable Overseas Employment Services

Flexible Loans and Advances

more than 300 number of branches

Complex financing services that require much attention to terms and policies when applying

Oromia Bank Information

Contact Information

- SWFIT ORIRETAA

- +251-11-55-72-113

- [email protected]

Diaspora Benefits

- Optional Diaspora Deposit Accounts

- Automobile Loan

- Mortgage Loan

- Working Capital Loan

- Consumer Loan

Internet Banking

- Can Check Balance

- Can Transfer Money

- View Account Statement

- Can Control Progress

- Can Pay Bills Online

Mobile Banking

- Mobile Application

- Balance Inquery

- USSD Application

- Mobile Top Up

- Money Transfer

Loan Interest

- Personal Automible Loan 14

- Diaspora Mortgage Loan 9.8

- Corporate Loan 14

- Investment Loan 14

- Working Capital Loan 14

Saving Interest

- Personal Saving 7%

- Women Saving 7.5%

- Teen Saving 7.5%

- Education Saving 7.5%

Apply for a loan here

Banks Ethiopia gives you the access and information you need to get car loan and house loan services in Ethiopia from the bank of your choice. If you are a non resident and/or a foreigner with origin of Ethiopia looking for these loan services, make sure to visit our diaspora mortgage loan and diaspora vehicle loan pages to acquire a more detailed information.

Oromia Bank Exchange Rate

Oromia Bank exchange rateis found at our exchange rates page, along with all other banks’ exchange rates in Ethiopia today.

| code | buying | selling | Difference |

|---|---|---|---|

USD ($) |

133.97

|

136.65

|

± 2.67 |

GBP (£) |

176.52

|

180.05

|

± 3.53 |

EUR (€) |

148.43

|

151.39

|

± 2.96 |

CHF (CHF) |

168.01

|

171.37

|

± 3.36 |

SAR (ر.س) |

35.72

|

36.43

|

± 0.71 |

AED (د.إ) |

36.47

|

37.20

|

± 0.72 |

[ez-toc]

About Oromia Bank

Oromia Bank is one of the commercial private Banks with years of experience in Ethiopia. Oromia has a well-built professional profile and records showing. The Bank has a mission of becoming the best fully-fledged commercial banking service provider by giving the best, dedicated, and sustainable service to its customers through its valuable and highly qualified employees and fulfill social responsibility. Oromia Bank branches have reached more than 500 across the country with 5.4 paid up capital.

History of Oromia Bank

Oromia Bank SC (OB) formerly known as Oromia International Bank (OIB) was established on the 18th of September, 2008 according to the 1960 commercial code of Ethiopia, the required Banking Proclamation number 94 of 1994, and the license and supervision proclamation number 592 of 2008.

Oromia Bank has begun its operations a month after its foundation on the 25th of October, 2008. Opening its first branch in Addis Ababa, Bole area, OIB started with an initial authorized capital of 1.5 Billion Birr.

The Bank has led its operation under the name of Oromia International Bank(OBI) for 13 years ( from 2008 to 2021) and made an amendment to its company logo and name in 2022. As the officials of the Bank explained in their announcement ceremony, the changes are in regards of bringing the Bank to a Better growth path.

Key Takeaways

- Full information about Oromia Bank

- services of Oromia Bank

- Oromia Bank head office location

- Oromia Bank mobile Banking

Services provided by Oromia Bank

Oromia Bank Saving Accounts

- Oro Saving

An interest-bearing account rendered for ever-eligible physical and legal persons including organizations and associations etc.

- Oro Saving Plus

A saving account for credit scheme provided for Individuals /employees of a company who would like to put savings and access a House or car loan service targets individuals particularly employees where they save a certain amount of money to get a loan for the purchase of a vehicle and/or a house i.e. it is a saving account that attaches loan privilege.

- Oro Interest Plus (Special Saving account)

Oromia Bank gives a high and attractive savings interest rate compared to the normal savings accounts, customers of the account would be selected from the group

- Fixed time (special saving Account)

Customers who would like to get long-term savings services can choose this account type, customers would have a one-time fixed agreement with Oromia Bank and make their deposit to the investment Bank and agree to possession minimum of 90 days of their account for the agreeable amount of time and get benefit from the high-interest rate.

Oromia Bank Special Accounts

Handura children’s

Provided for parents/legal guardians to make a savings deposit for their under-aged children (under 18 years)

Handura saving is available under two categories

- Handura (0-10 years)

- Handura (11 to 18 years)

Sinqe Women’s

Provided to enhance women saving habits with special accounts and saving interest

Hayu Education

Saving account for tertiary level students who receive education money from their parents/legal guardians/relatives

Oro Retirement

A saving account provided by elders the age of 60 and above, this account is provided to support and reward elders for their path of life.

Oromia Bank Diaspora Account

Diaspora banking service is provided by Oromia Bank to support customers’ dream achievement in their homeland

Oromia Bank diaspora banking is:-

- Diaspora Current Account

- Fixed or Time Deposit Account

- Non-repatriable Birr Account

Who is eligible for Oromia Bank Diaspora Banking service:-

- Citizens living or working in the country

- Nonresident Foreigners from the Ethiopian region

Types of Diaspora Accounts

- Diaspora Current Account

- Fixed or Time Deposit Account

- Non-repatriable Birr Account

Requirements to access Oromia Bank Diaspora Banking service

- Renewed passport/identification card

- Leaving license

- Properly filed and signed application form

- Certification of ownership/momentum of association

- Minimum deposit of 100 USD/5000 USD for fixed-time account type

Oromia Bank gives allowance to legally represented Authority to open accounts on behalf of the customer and customers are beneficial from the account and make international and domestic payments/transactions, withdraw cash for travel purposes, make an exchange of their deposit to birr at the exchange rate of the time of withdrawal.

Oromia Bank provides this service with currencies of USD, EURO, and Pound sterling.

Checking Business Account

- Oro Current :-customers can process transactions and Banking routines by representing a legal third parties through the Bank branches or through the online banking services.

- Salary Solution :- designed for salaried individuals and for companies to process employee payments through the bank

- Investment Solution :- designed for individuals/organization with regular income and interest to save a fixed amount per a month for a fixed period of time and benefit from higher interest rate.

- Provident Fund :- special deposit time with a special benefits for organizations and three employees including an access to loan facilities.

Oromia Bank Loan and Advances

1, Personal loan

A personal loan is provided for customers to use for financial emergency needs like medical incidents, travel finances, or any financial liabilities. The bank provides up to 500,000 ETB loan amount with 5 years of repayment season.

2, Business Loan

Business Loan is a short-term limited credit loan service provided for customers who need Business/project financing. The agreement with the customer can be reviewed and renewed on an annual base according to the customer’s account status.

3, Vehicle/Auto Loan

Auto Loan is provided to finance a customer’s purchase of a used and/or new car for non-commercial purposes.

The loan has a 70-80% amount coverage based on the vehicle’s condition with a 5-8 years repayment period.

4, Diaspora Mortgage loan

This service is provided for the Diaspora customer, in definition nonresident Citizens and/or nonresident foreigners of Ethiopian Origin with the purpose of building/purchasing a resident house

Oromia Bank Interest-Free Banking

Oromia Bank provides Interest-free Banking following all the Sharia law and regulations. Customers are to be treated and provided services as equally as the interest bearing customers. IFBW (Wadi’ah) is provided on a window level of every branch, what makes this service a good choice is that there is an IFB for every Interest bearing service.

- Wadi’ah saving account

Wadi’ah saving: is a safety/ custody deposit where customers make a saving deposit and withdraw when they like to do so

Labbaik-Wadi’ah : savings for Islamic religious traveling purposes like Hajj

Mudarabah Investment: cost-plus service for individuals and companies involved in import, export, car business, providing raw materials

- Wadi’ah special saving account

Similarly to interest-bearing special saving accounts, these services are provided for women, children, and elders but only under the fulfillment of Sharia rules

Services include:-

Sinqe Women’s Wadi’ah saving, Handhura children’s Wadiah savings,Wadi’ah retirement account, Educational Wadi’ah saving

- Financial Service

Oromia provides all the financial services of normal(interest-bearing) services arranged with Sharia rules and provides Interest-free service

Services Include:-

Murabaha, Interest-Free Export Facility, Ijarah Financing, Salam interest-free financing

Oromia Bank International Banking

Oromia Bank provides a special service that allows customers all over the world to process their day to day Banking services through international service

- International trade service: for customers involved with Import, Export business.

The Bank provides Cash Against Documents (CAD) Letters of Credit (LC), allowing customers to process payment issues irrespective of the Bank’s regulation and requirement to access this account.

- International Money Transfer:- Inward and Outward money transfer through the Banks swift ( ORIRETAAXXX) for Bank to Bank transactions or through Many remote service providers the Bank has partnered with in this sector ( Western Union, Money Gram Trans Fast, Ria, Lari Exchange, Alansari Exchange, Money Exchange, Express Money, etc..)

- Correspondent Banks: Oromia Bank has made correspondent Bank account relationships and Bilateral Exchange arrangements with over 100 Banks of different continents.

Oromia Bank mobile Banking

The bank offers USSD-based services, allowing customers to access their accounts and perform transactions using their feature phones by dialing on *840#. or through Oromia Bank Mobile Banking provider application OROCLICK or/and OroApp. The Bank is known for its fast mobile Banking service in addition to its internet, card, Agent, ATM and branch services.

Review Conclusion

Oromia Bank has made progress throughout the years and grow to the current position it has reached. The Bank is currently known for its quality services, Mobile Banking, Interest-free and loan services. The bank has made visible upgrades starting from its name and logo amendment to the hard work that has led the Bank to recognition and receiving International awards like ESQR award for the second time starting from 2022.

Financial Reports

- Financial Performance: Oromia Bank reported a net profit of ETB 2,347 million (approximately USD 53 million) in 2023, representing a growth of 23% compared to the previous year.

- Assets: The bank’s total assets increased by 17% to ETB 134 billion (approximately USD 3.1 billion) as of December 2023.

- Loans and Advances: Oromia Bank’s gross loans and advances grew by 15% to ETB 94 billion (approximately USD 2.1 billion) as of December 2023.

- Capital Adequacy Ratio (CAR): The bank’s CAR stood at 14.32% as of December 2023, which is above the regulatory minimum requirement of 10%.

- Risk Management: Oromia Bank has implemented various risk management strategies to mitigate potential risks, including credit risk, market risk, and operational risk.

Oromia Bank contact Information

Oromia Bank Head Office

- Bole, Africa Avenue, Addis Ababa Ethiopia

Oromia Bank phone number

- Tel: +251 -11-51-83-880

- Tel: +251 -11-55-72-115

- Tel: +251 -11-55-72-002

- Tel: +251 -11-55-72-113

Current president of Oromia Bank :-

Gemechu Waktola (PhD)

7.1

Oromia Bank

Loan Interest

6.1

Mobile Banking

6

Internet Banking

6

Saving Interest

8.6

Customer Service

8

Diaspora Benefit

8

Customer Favourite Banks In Ethiopia

Show More