Proposal for Addressing Challenges in Ethiopia’s Technology Sector

Introduction

This proposal addresses critical challenges hindering the development of the technology sector in Ethiopia and across Africa. It outlines key problems and proposes actionable solutions to foster innovation, growth, and trust between the government and the private sector.

Problem Statement

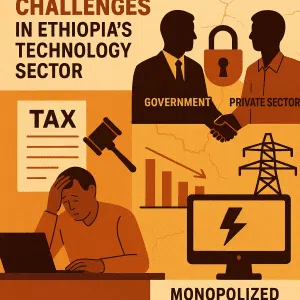

As a company operating within Ethiopia’s legal framework, we face significant obstacles in creating and capturing value in the technology sector. These challenges stem not from a lack of potential but from systemic issues that limit growth and innovation. The primary concerns include:

Lack of Trust Between Government and Private Sector: A pervasive mentality of mistrust shapes interactions. The government often assumes companies are non-compliant, leading to excessive scrutiny and regulations. In response, some private sector entities evade oversight, perpetuating a cycle of distrust.

Complex Regulatory Environment: Current laws and bureaucratic processes create barriers for the majority of compliant businesses. For example, obtaining a business license can take six months to a year, with requirements such as foreign authentication and powers of attorney that are impractical for startups.

High Taxation and Rigid Labor Laws: Companies face a tax burden of up to 45% (including pension and income tax) for employees earning above 10,000 ETB, a threshold considered high income in Ethiopia. This limits liquidity for growth. Additionally, labor laws protect underperforming employees, discouraging efficiency.

Monopolized Markets and Infrastructure Challenges: Government control over critical sectors, such as internet connectivity, stifles innovation. High costs and unreliable internet access hinder startups, particularly in an era where big data and AI demand robust infrastructure.

Survival vs. Growth Mindset: Most companies in Ethiopia focus on survival rather than growth, as regulatory and economic pressures discourage long-term investment and innovation.

Proposed Solutions

To address these challenges, a fundamental shift in mindset and policy is required. The following recommendations aim to simplify processes, foster trust, and enable the private sector to drive technological advancement.

1. Simplify Business Setup and Operations

Streamline Licensing Processes: Reduce the time required to obtain a business license to a maximum of one week, emulating startup-friendly environments like Delaware, USA. Eliminate unnecessary requirements, such as foreign entity authentications and powers of attorney, to make Ethiopia an attractive destination for entrepreneurs.

Outcome: Faster company formation will encourage innovation and attract both local and foreign investment.

2. Build Trust Through Education

Educate the Private Sector: Shift focus from policing to educating businesses on the importance of paying their fair share of taxes and complying with regulations. Transparent communication about the benefits of compliance can foster a culture of responsibility.

Outcome: A cooperative relationship between the government and private sector will reduce evasion and increase tax revenue without stifling growth.

3. Reform Taxation and Labor Laws

Reduce Employee Tax Burden: Lower the combined pension and income tax rate for employees earning above 10,000 ETB to increase company liquidity and incentivize hiring. Reassess the 10,000 ETB threshold, as it disproportionately affects businesses in a low-income economy.

Modernize Labor Laws: Reform labor laws to balance employee protections with employer flexibility, ensuring that underperforming employees do not hinder productivity.

Outcome: Reduced financial strain on companies will enable reinvestment in growth and innovation.

4. Demonopolize Critical Infrastructure

Liberalize Internet Access: Approve technologies like Starlink or similar solutions to provide affordable, high-speed, and reliable internet access for startups. Reduce government control over telecommunications to encourage competition and innovation.

Outcome: Improved connectivity will empower businesses to compete in the global AI and big data landscape, creating a more resilient economy.

5. Prepare for AI-Driven Economic Shifts

Foster a Skilled Workforce: Encourage private sector-led training programs to develop a workforce capable of competing in an AI-driven global economy. This is critical as diaspora remittances may decline due to job losses from AI automation abroad.

Promote Market-Driven Innovation: Allow the private sector to lead technology development by reducing government monopolies and fostering a competitive market environment.

Outcome: A skilled, adaptable workforce and a dynamic private sector will position Ethiopia to thrive in the global economy.

Conclusion

The technology sector in Ethiopia and Africa holds immense potential, but systemic barriers prevent its full realization. By simplifying regulations, fostering trust, reforming taxation and labor laws, liberalizing infrastructure, and preparing for AI-driven changes, the government can empower the private sector to drive innovation and growth. These changes will shift the focus from survival to thriving, creating a vibrant ecosystem that benefits both Ethiopia and the broader African continent.